Connecting all of the data sources you need

Your New Buy-To-Let Investing Toolset

Make smarter buying decisions, with a range of powerful tools and features designed for property investors. The Buy-To-Let Platform connects properties from the largest real estate listing sites to mortgages from hundreds of lenders.

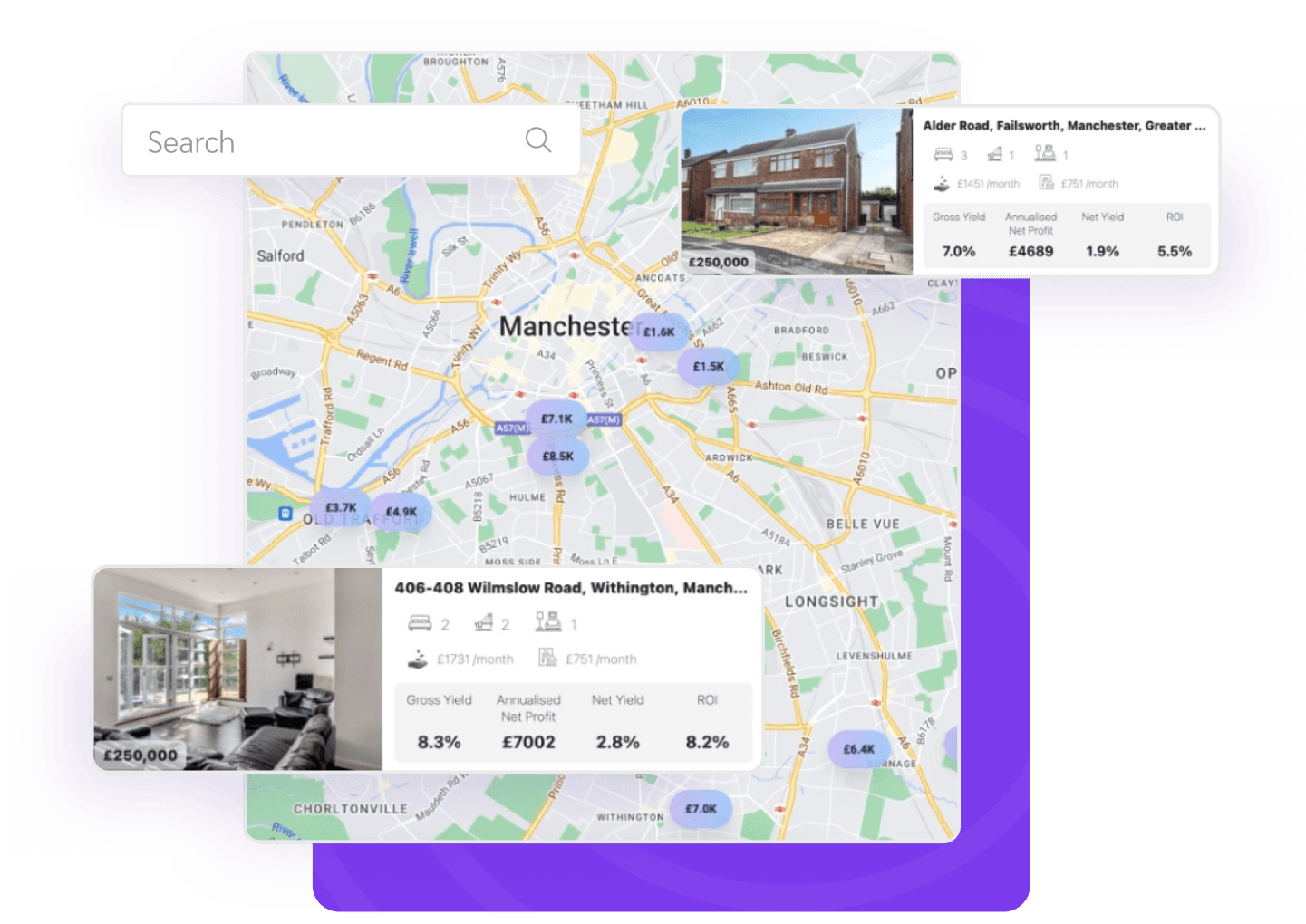

Live Property Listings

Search and browse UK property listings built for buy-to-let landlords; with all the data you need to spot worthwhile investments. Benefit from real-time mortgage offers and advanced rent analysis to make informed decisions quickly and efficiently.

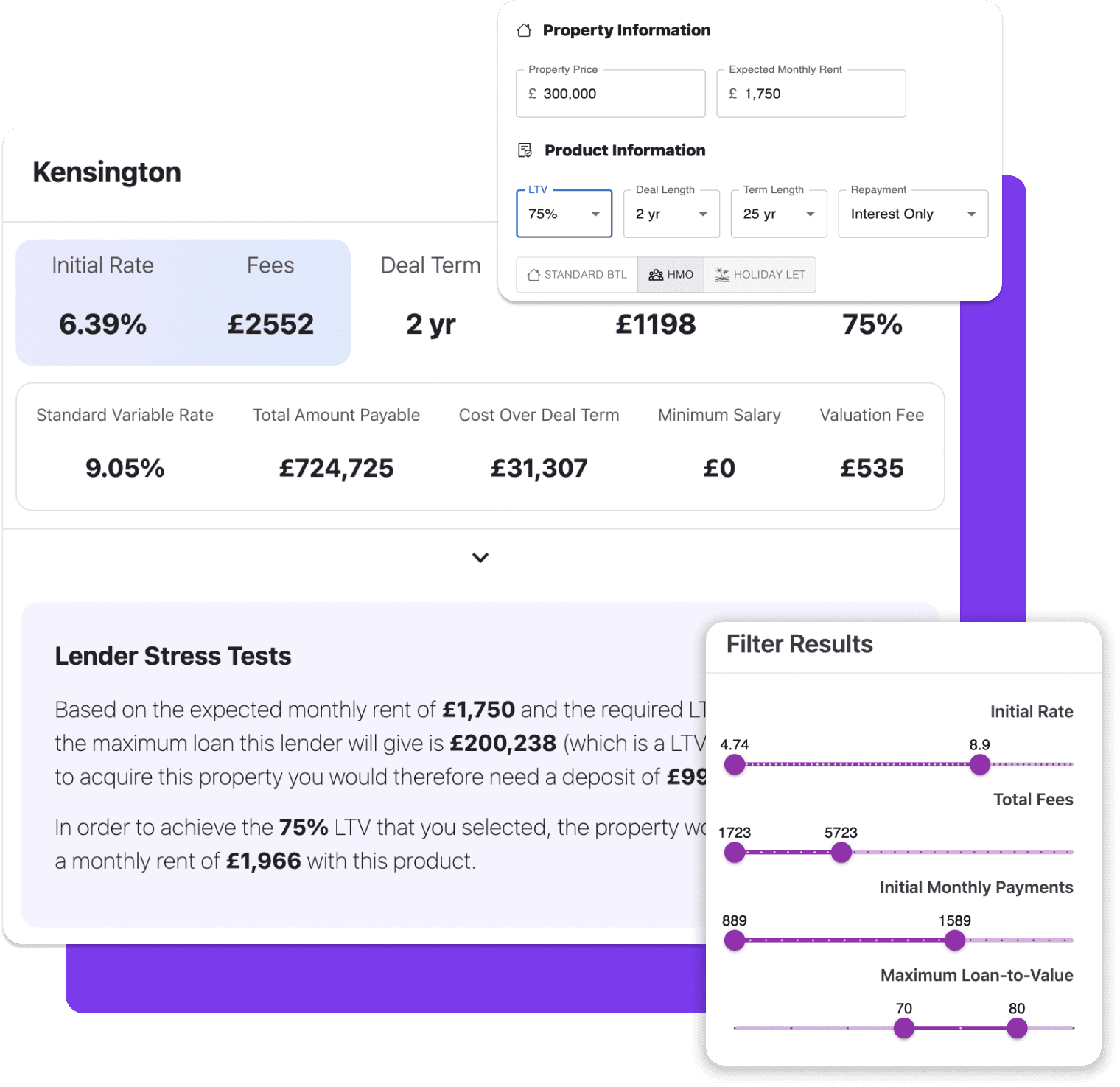

Live Mortgage Data

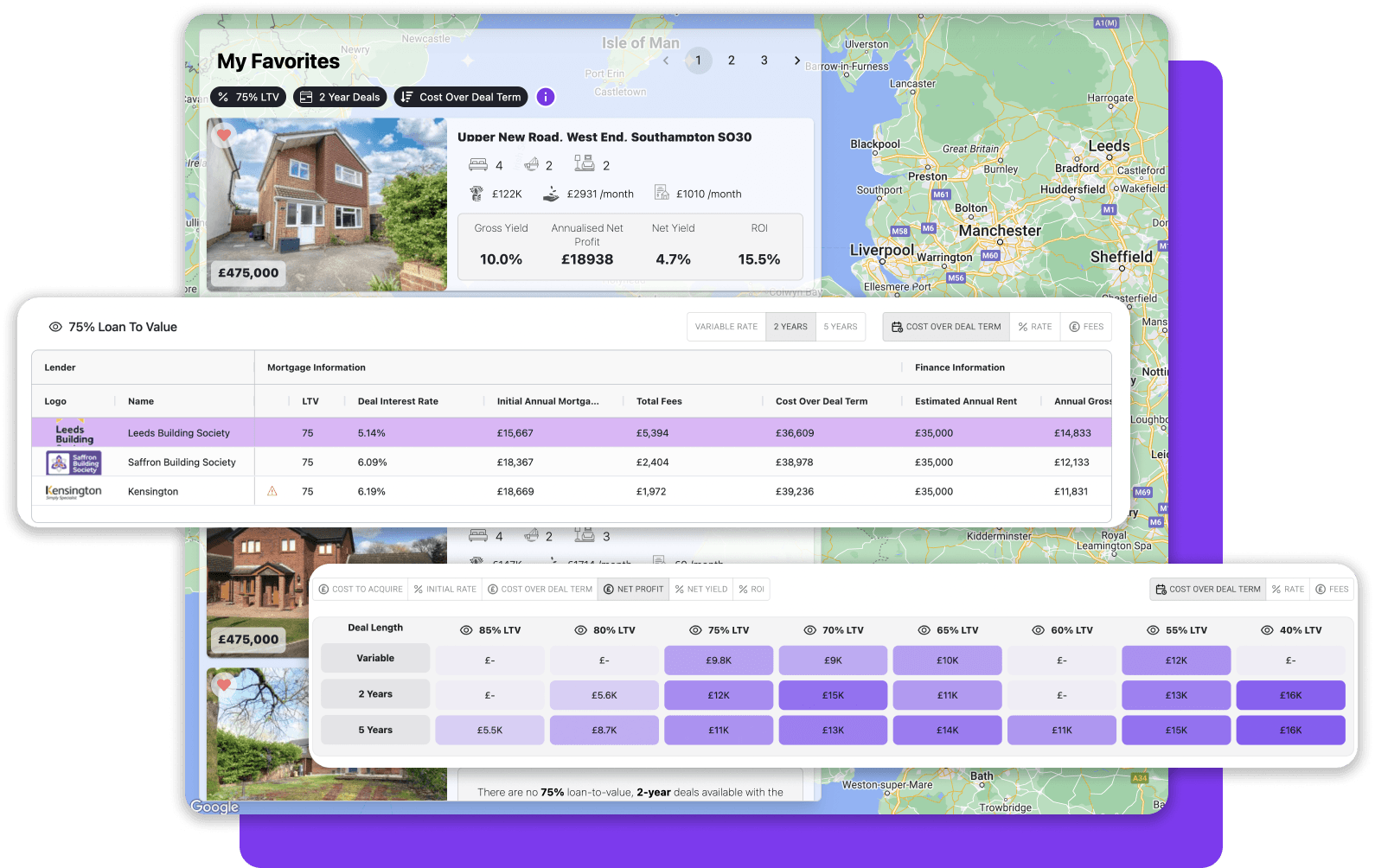

Get real-time bespoke SPV mortgage offers and instantly see which listings work within your borrowing parameters. Utilise the platform's advanced analytics to streamline your investment strategy, ensuring a perfect match between properties and your financial goals.

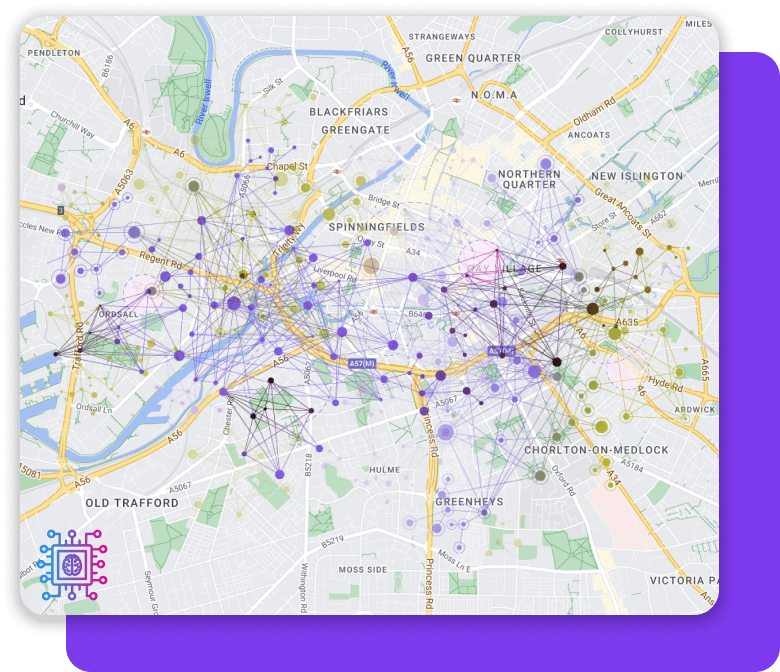

Machine Learning Rent Analysis

Each listing comes with accurate gross yield and net yield estimates, which are calculated using our machine-learning models. This sophisticated approach ensures a high level of precision in forecasting potential returns, making your investment decisions more data-driven and reliable.

Favourites

Find property fit for investment and conduct a deeper analysis of limited company mortgages. Review rates, overall product and acquisition cost, net yields, and ROI easily in one table. With our powerful favourites analytics, you can select and compare two-year deals to five, fixed to variable, side by side.

5.0

Any Questions?

The BTLPlatform is the new way for buy-to-let investors to source properties and find the best limited company mortgage deals.

Simply sign up and input your mortgage preferences, and you’ll be able to start browsing property listings by typing in the area you’re interested in.

You can also use our free calculator tool to instantly see the top three SPV mortgage deals for your investment needs, with a full breakdown of costs and profit for each.

For a guided tour of the BTLPlatform, simply get in touch with our team today.

Above all else, a buy-to-let investment needs to make more money than it takes to purchase and maintain it.

That means understanding the costs of a potential property purchase - deposit requirements, mortgage repayments, stamp duty etc. - as well as the rental yields and how all those numbers will influence your net profit.

Unfortunately, traditional property listings on portals like Rightmove and Zoopla are missing all those details. That’s because those listings are designed for homebuyers, not buy-to-let investors like you.

The BTLPlatform puts all that data in YOUR hands, so you can quickly identify which properties are suitable for your investment needs.

The BTLPlatform makes it easy to track down properties which can offer high rental yields for investors.

As well as displaying investment and mortgage data with each property listing, you can also filter your property search results to pinpoint the high-yield properties you’re after.

The risks in property sourcing are multifaceted. Working with mortgage brokers can be complex, as it requires navigating various financial products and understanding the implications for your investment. Effective project management is crucial to handle the operational aspects of property development and maintenance.

Assessing capital growth potential accurately is vital for long-term investment success. When buying property, paying above market value can significantly affect the investment's profitability, making thorough market research and valuation essential. It's important to be well-informed in these areas to effectively mitigate risks.